(TheNewswire)

Vancouver, British Columbia, July 3rd, 2025 TheNewswire - Prismo Metals Inc. (the " Company ") (CSE: PRIZ) (OTCQB: PMOMF) is pleased to announce that it has signed option agreements to acquire 100% interest in two historic high-grade precious and base metal mines — the Silver King and Ripsey mines — both located in Arizona's prolific Copper Belt near its flagship Hot Breccia project.

Additional information on the Silver King and Ripsey mines as well as Prismo's other projects (Hot Breccia and Palos Verdes) is available on Prismo's Youtube channel at:

Exceptional Grades and Untapped Potential

Discovered in 1875, the Silver King mine is one of Arizona's most important historic producers, yielding nearly 6 million ounces of silver at grades of up to 61 oz/t. Remarkably, selected samples from small-scale production in the late 1990s returned grades as high as 644 oz/t silver (18,250 g/t) and 0.53 oz/t gold (15 g/t), indicating that high-grade mineralization remains. Additionally, the presence of freibergite (AgCuSbS) suggests a potential for antimony, a critical mineral with growing strategic demand.

The Ripsey mine, located 20 km west of Hot Breccia, is also an historic gold-silver-copper producer with significant upside. Historic sampling has returned up to 15.85 g/t gold and 276 g/t silver, yet no modern exploration has been conducted.

Strategic Location — World-Class Neighbors

The Silver King mine sits only 3 km from the main shaft of the Resolution Copper project — a joint venture between Rio Tinto and BHP and one of the world's largest unmined copper deposits with an estimated copper resource of 1.787 billion metric tonnes at an average grade of 1.5% copper (1) . This unique land position is fully surrounded by Resolution Copper's claim block, offering strategic upside.

"The Silver King and Ripsey mine projects are exciting additions to our Arizona portfolio. We see an opportunity to create near term value through immediate exploration on a historic high-grade silver producer with antimony potential that has seen limited modern exploration by drilling both laterally and at depth into a prospective source formation, said Gordon Aldcorn, President of Prismo. "We look forward to getting our exploration team back in the field, advancing our exciting projects and revitalizing investor interest in the Company."

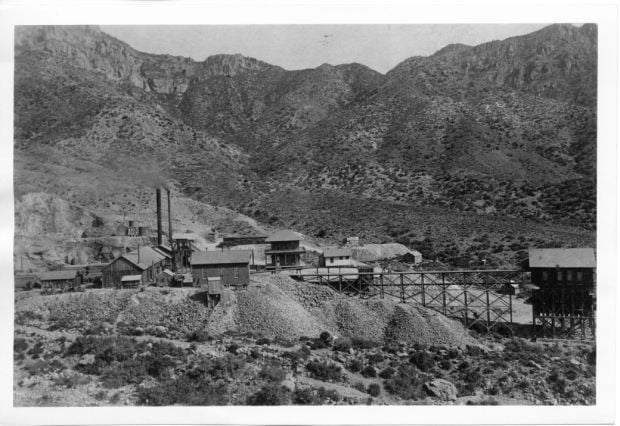

The Silver King mine was discovered in 1875 and produced ore with as much as 10,000 ounces per ton silver in near surface workings (2) . Underground production through 1889 is estimated at almost 6 million ounces of silver at grades of between 61 and 21 ounces per ton. During a second period of production from 1918 to 1928, 230,000 ounces were produced at a grade of 18.7 ounces per ton. No significant production has occurred after 1928.

The orebody at Silver King is a steeply west-dipping pipelike stockwork and breccia zone that was mined on eight levels to about 300 meters depth below a glory hole at the surface. The pipe is described as a dense stockwork with local breccia zones and a quartz core (3) . Records indicate that due to variations in mineralogy, much of the upper portion of the body was evidently not mined. The current owners (the " Optionor ") rehabilitated the main shaft in the late 1990s, opened the upper levels of the mine and produced a small tonnage. Assay certificates from this period show selected samples with 400 to 600 ounces per ton silver with 0.2-0.5 oz/t gold and some base metals. Virtually no modern exploration has been carried out at the mine providing significant exploration upside and multiple drill targets.

The Ripsey mine is a historic gold-silver-copper producer located about 20 km west of the Hot Breccia project. Historic mine workings consisting of tunnels and shafts on several levels were developed along a vein over about 400 meters of strike length and 160 meters vertically. A small tonnage of mineral was produced by the Optionor in the late 1990's. Sampling by Dr. Craig Gibson from the mine workings has yielded 15.9 g/t gold and 275 g/t silver over 0.75 meters and 8.7 g/t gold, 181 g/t silver, 3% copper and 9% zinc over 1 meter. No modern exploration has been carried out at the project, providing significant exploration upside and multiple drill targets.

The Company plans to conduct a detailed mapping and sampling program at both projects at surface exposures and in accessible workings. A drill program is planned for Silver King, with about 1,000 meters initially. The Silver King drill program is designed to test the mineralized body at four elevations as well as lateral to the pipelike body. De-watering of the Silver King shaft to gain access to the upper levels may also be undertaken as submersible pumps are in place.

"This is a fabulous opportunity for the Company. Both projects are high-grade and are easily accessible and may be associated with porphyry copper mineralization. We also look forward to evaluating the potential for antimony at Silver King. We're excited to begin exploration immediately to test the Silver King's pipelike mineralized body at multiple depths and laterally," said Dr. Craig Gibson , Chief Exploration Officer. "This region is world-class for porphyry systems and base and precious metals, and we believe these mines have significant untapped potential."

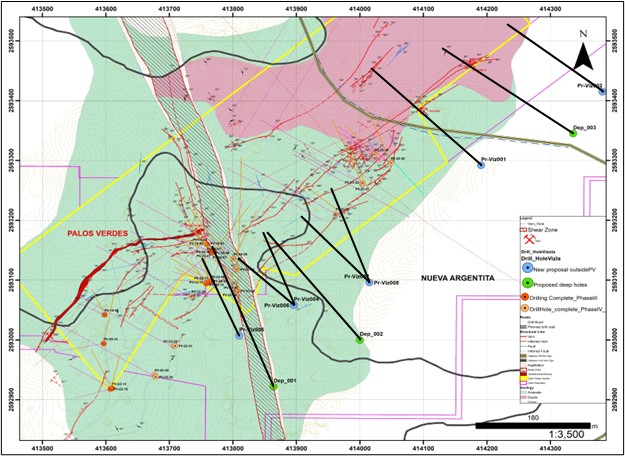

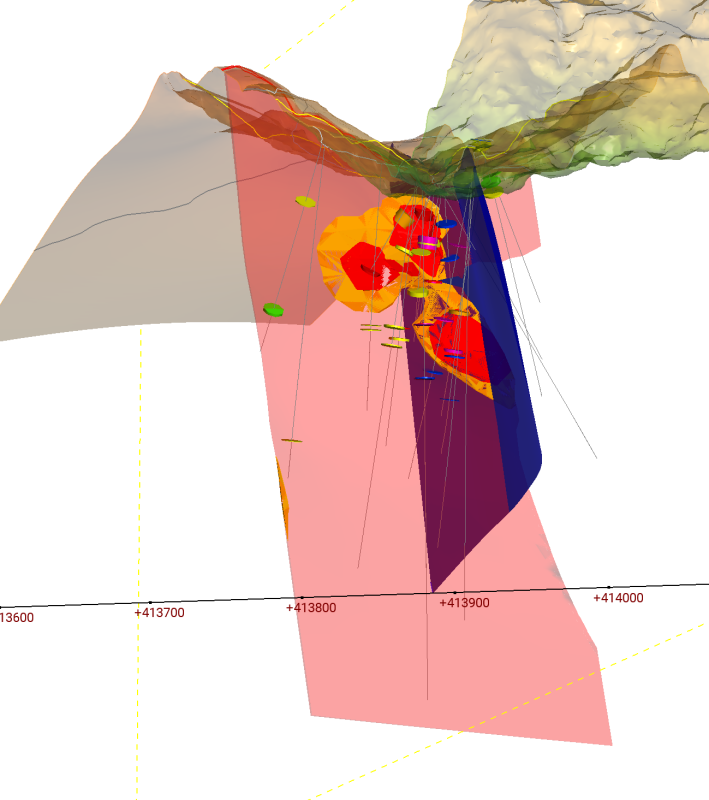

Location of the Company's projects withing the Arizona Copper Belt

Land map of the Silver King mine.

Drone view of the Silver King mine.

The Silver King mine in the late 1800's.

Click Image To View Full Size

Click Image To View Full Size

Small scale mining in the upper levels of the Silver King mine in the late 1990's.

Deal description

Prismo has the option to acquire a 100% interest in both the Silver King and Ripsey mines. Prismo can earn a 100% interest in the Ripsey mine by issuing one million shares to the Optionor, paying the Optionor US $10,000 within six months of the signing of the option agreement (the " Effective Date "), US $10,000 on each anniversary of the Effective Date and US $1 million to the Optionor within five years of the Effective Date. Prismo does not have minimum work commitments as part of the Ripsey option agreement.

Regarding the Silver King mine, Prismo can acquire a 100% interest in three stages. Prismo must issue one million shares to the Optionor, pay the Optionor US $10,000 within six months of the Effective Date, and US $10,000 on each anniversary of the Effective Date. To earn a first 50% interest, Prismo must incur no less than US $500,000 in expenditures on or before the first anniversary of the Effective Date, incur no less than an additional US $2.5 million expenditures on or before the third anniversary of the Effective Date and issue to the Optionor two million shares. Prismo can acquire an additional 30% interest by incurring no less than an additional US $3 million in expenditures, paying the Optionor US $1 million and issuing to the Optionor two million shares before the fifth anniversary of the Effective Date. Prismo can elect to form a joint venture at anytime after earning it initial 50% interest. The option agreement and joint venture agreement terms and conditions contain standard buyout and dilution terms regarding the final 20% interest.

Prismo is also pleased to announce a non-brokered private placement (the " Private Placement ") of five million units of the Company (" Units ") at an issue price of $0.05 per Unit for minimum gross proceeds of $250,000. Each Unit will consist of one common share in the capital of the Company (a " Share ") and one-half of one common share purchase warrant of the Company (each whole warrant, a " Warrant "). Each Warrant will entitle the holder to purchase one Share for a period of twenty-four (24) months from the date of issue at an exercise price of $0.10.

The Private Placement will also be made available to existing shareholders of the Company who, as of the close of business on July 1st, 2025, held Shares (and who continue to hold such Shares as of the closing date of the Private Placement), pursuant to the existing securityholder exemption set out in BC Instrument 45-534 – Exemption From Prospectus Requirement for Certain Trades to Existing Security Holders (the " Existing Securityholder Exemption "). The Existing Securityholder Exemption limits a shareholder to a maximum investment of CAD$15,000 in a 12-month period unless the shareholder has obtained advice regarding the suitability of the investment and, if the shareholder is resident in a jurisdiction of Canada, that advice has been obtained from a person that is registered as an investment dealer in the jurisdiction. If the Company receives subscriptions from investors relying on the Existing Securityholder Exemption exceeding the maximum amount of the Private Placement, the Company intends to adjust the subscriptions received on a pro-rata basis.

The Units issued pursuant to the Private Placement and the Existing Securityholder Exemption will be subject to a four-month hold period from the closing date of the Private Placement under applicable Canadian securities laws, in addition to such other restrictions as may apply under applicable securities laws of jurisdictions outside Canada.

The Company intends to use the net proceeds of the Private Placement for general corporate purposes. The Company may pay finder's fees to eligible finders in connection with the Private Placement, subject to compliance with applicable securities laws and Canadian Securities Exchange policies.

The securities being offered have not been and will not be registered under the U.S. Securities Act and may not be offered or sold in the United States, or to, or for the account or benefit of, U.S. persons or persons in the United States, absent registration or an applicable exemption from the registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any State in which such offer, solicitation or sale would be unlawful.

Debt Settlements

Prismo also announces that it has entered into debt settlement agreements (the " Settlement Agreements ") with certain creditors of the Company (the " Creditors ") pursuant to which the Company agreed to issue to the Creditors, and the Creditors agreed to accept, an aggregate of 160,000 shares of the Company (each, a " Share ") in full and final settlement of accrued and outstanding indebtedness in the aggregate amount of $11,000 (the " Debt Settlement "). All securities issued pursuant to the Debt Settlement will be subject to a statutory hold period of four months from the date of issuance, in accordance with applicable policies of the Canadian Securities Exchange.

Share and Warrants Issuance

A private company dealing at arms' length with Prismo, its officers and directors, had certain rights into the Silver King and Ripsey mines (" PrivateCo "). In consideration for PrivateCo relinquishing its rights in the Silver King and Ripsey mines in favor of the Company, Prismo has agreed, subject to regulatory approval, to issue PrivateCo five million units (the " Units "). Each Unit is comprised of one common share (a " Share ") and one share purchase warrant (a " Warrant "). The Shares will become free trading as to 25% every six months from the Effective Date. Two million of the Warrants will be exercisable at $0.10 (" First Tranche ") and three million Warrants will be exercisable at $0.15 (" Second Tranche "), all for a period of three years. The shares from the exercise of the Warrants will become free trading as to 25% every six months from the Effective Date. In addition, the exercise of the First Tranche is conditional on Prismo having raised $1.5 million from parties introduced to Prismo by the principals of PrivateCo and the exercise of the Second Tranche is conditional on Prismo having raised $3.0 million from parties introduced to Prismo by the principals of PrivateCo.

Qualified Person

Dr. Craig Gibson, PhD., CPG., a Qualified Person as defined by NI-43-01 regulations and Chief Exploration Officer and a director of the Company, has reviewed and approved the technical disclosures in this news release. Other than the sampling conducted by Dr. Craig Gibson as indicated herein, the data presented in this press release was obtained from public sources, should be considered incomplete and is not qualified under NI 43-101, but is believed to be accurate. The Company has not verified the historical data presented and it cannot be relied upon, and it is being used solely to aid in exploration plans.

1) https://resolutioncopper.com/about-us/

2) Galbraith, F, 1935, Geology of the Silver King area, Superior, Arizona, Univ. of Arizona thesis, 153p plus plates.

3) Blake, W.P., 1883, Description of the Silver King Mine, Arizona, New Haven, 48p plus plates.

About Prismo Metals Inc.

Prismo (CSE: PRIZ) is a mining exploration company focused on advancing its Hot Breccia copper project in Arizona and its Palos Verdes silver project in Mexico.

Please follow @PrismoMetals on , , , Instagram , and

Prismo Metals Inc. , 1100 - 1111 Melville St., Vancouver, British Columbia V6E 3V6

Contact:

Alain Lambert, Chief Executive Officer [email protected]

Gordon Aldcorn, President [email protected]

Cautionary Note Regarding Forward-Looking Information

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". This information and these statements, referred to herein as "forward‐looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management's expectations and intentions with respect to, among other things: the timing, costs and results of drilling at Hot Breccia.

These forward‐looking statements involve numerous risks and uncertainties, and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things: delays in obtaining or failure to obtain appropriate funding to finance the exploration program at Silver King and Ripsey. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, that: the ability to raise capital to fund exploration and the timing of such exploration.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward- looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. We seek safe harbor.

NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES

OR FOR DISSEMINATION IN THE UNITED STATES

Copyright (c) 2025 TheNewswire - All rights reserved.

![[VIDEO ENHANCED] Prismo Metals Options Two High-Grade Silver-Gold Mines in the Arizona Copper Belt - Immediate Exploration Planned](https://investingnews.com/media-library/image.jpg?id=27864595&width=1200&height=801)