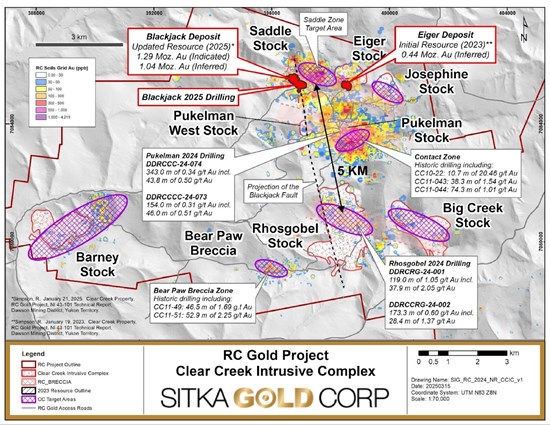

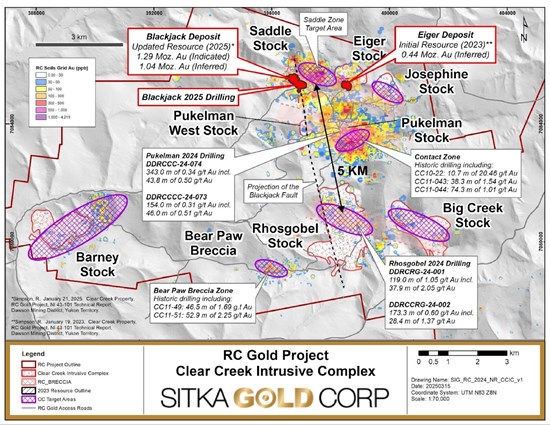

Sitka Gold Corp. (TSXV: SIG) (FSE: 1RF) (OTCQB: SITKF) ("Sitka" or the "Company") is pleased to announce assay results and provide an update on the 30,000 metre planned diamond drill program currently in progress at it 100% owned RC Gold Project located in the Yukon's prolific Tombstone Gold Belt (see Figure 5). The drilling is progressing exceptionally well, with over 10,000 metres of the planned 30,000-metre program already completed ahead of schedule and under budget. Visible gold has been observed in multiple drill holes across all the target areas currently being drilled, namely the Blackjack, Saddle, Eiger and Rhosgobel (see Figure 4). Results have been received and compiled for the first completed drill hole of the season, DDRCCC-25-077, returning 211.2 metres of 1.13 g/t gold, including 73.2 metres of 2.05 g/t gold, from the drilling in the Blackjack deposit expansion program. A total of 23 holes have been completed in the 2025 drilling program with 7 holes in the Blackjack deposit expansion, 4 holes in the Eiger deposit expansion, 9 holes in the Saddle zone, which lies within the conceptual pit limits of the Blackjack deposit, and three holes in the Rhosgobel intrusion which is located five kilometres to the south of the Blackjack-Saddle-Eiger drilling (see Figures 2, 3 and 6). Results are currently pending for the additional holes that have been completed to date at RC Gold.

- Visible gold intersected in all target areas drilled including the first 3 holes drilled this year at the Rhosgobel target

- DDRCCC-25-077 intersects 211.2 m of 1.13 g/t gold including 73.2 m of 2.05 g/t gold

- Over 10,000 metres in 23 holes of planned 30,000 m drill program completed to date

- Sitka collars 100th drill hole on the RC Gold Project since initial drilling began in 2020

- Four drill rigs currently turning at the Blackjack, Saddle, Eiger and Rhosgobel zones

Table 1: Assay highlights for this release

*Intervals are drilled core length, as insufficient drilling has been completed at this time to determine true widths.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6144/256905_3dc0f48084f9b993_002full.jpg

"While we are still awaiting assays results for nearly all the holes completed since the start of our summer drill campaign, the presence of visible gold in drill core across all our target areas is a strong indication that our drilling program is successfully expanding our existing deposits and uncovering new zones with the potential to host additional gold deposits," said Cor Coe, Director and CEO of Sitka. "We are especially excited about the Rhosgobel target where VG has been observed in all three holes drilled so far this year, with the deepest observation at a down-hole depth of 314.7 metres in DDRCRG-25-004. This bodes very well for the discovery of an additional gold deposit at Rhosgobel, where the first ever diamond drill hole was completed last year and returned strong gold values of up to 164.8 metres of 0.82 g/t gold starting 9 metres from surface, including 119.0 metres of 1.05 g/t gold, 37.9 metres of 2.05 g/t gold and 11.5 metres of 4.32 g/t gold (see news release dated November 25, 2024). We look forward to a steady flow of assay results in the coming weeks and months as we work to showcase the potential of the Clear Creek Intrusive Complex to host multiple multi-million ounce gold deposits."

BLACKJACK DEPOSIT DRILLING

The drilling to expand the Blackjack deposit continues to intersect gold mineralization outside of the current pit-constrained mineral resource. Drilling is targeting both shallow and deeper portions of the Blackjack deposit and results from the first hole of the summer drilling campaign, DDRCCC-25-077, intersected 211.2 metres of 1.13 g/t gold including 73.2m of 2.05 g/t gold. An additional four holes totaling approximately 2,030 metres have been completed with all drill holes reported to contain observations of visible gold.

Figure 1: Cross Section of DDRCCC-25-077

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6144/256905_3dc0f48084f9b993_003full.jpg

SADDLE ZONE DRILLING

The Saddle zone is located midway between the Blackjack and Eiger deposits and lies within the conceptual pit limit of the Blackjack mineral resource estimate. The Saddle zone drilling is designed to outline an initial resource in the Saddle zone area. Drilling in the Saddle zone has intersected quartz veining within weakly to moderately mineralized biotite schist cut by variably mineralized quartz monzonite dykes and sills and lamprophyre dykes. Visible gold has been observed within sheeted quartz veins cutting both the quartz monzonite dykes and mineralized metasediments.

EIGER DEPOSIT DRILLING

The Eiger deposit has not been drilled since its initial discovery in 2021. Drilling is planned to expand the deposit which is open in all directions. The Eiger intrusion consists of a fine grained diorite cut by occasional aplite and feldspar porphyry dykes. Quartz veining has been intersected within the metasediments and intrusive rocks in the current drilling with visible gold overserved in both metasediments and intrusives.

RHOSGOBEL TARGET DRILLING

Drilling has commenced on the Rhosgobel target with 3 holes collared to date stepping out from the discovery holes DDRCRG-24-001 and 002 which intersected 119.0 metres of 1.05 g/t gold including 37.9 metres of 2.05 g/t gold and 173.3 metres of 0.60 g/t gold including 28.4 metres of 1.37 g/t gold respectively (see news release dated November 25, 2024) in the first two diamond drill holes ever drilled within this target area. Drilling has intersected quartz monzonite intrusive with mineralized quartz veining and numerous fault zones. All drill holes have contained observations of visible gold.

Figure 2: Plan map of northern portion of the Clear Creek Intrusive Complex (CCIC) showing the 2025 drilling in the Blackjack, Saddle and Eiger zones.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6144/256905_3dc0f48084f9b993_004full.jpg

Figure 3: Plan map of the Rhosgobel intrusion showing the 2025 drilling.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6144/256905_3dc0f48084f9b993_005full.jpg

Figure 4: Examples of visible gold observed at Rhosgobel in DDRCRG-25-004

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6144/256905_3dc0f48084f9b993_006full.jpg

Table 2: Summary of significant assay results from this release

*Intervals are drilled core length, as insufficient drilling has been completed at this time to determine true widths

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6144/256905_3dc0f48084f9b993_007full.jpg

Figure 5: Regional map of the RC Gold Project located in the western portion of Yukon's prolific Tombstone Gold Belt.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6144/256905_3dc0f48084f9b993_008full.jpg

Figure 6: A plan map of the Clear Creek Intrusive Complex (CCIC) showing the updated resource areas at Blackjack and Eiger, and the six additional areas that have drill targets indicated by the mauve hatched areas. The map highlights the numerous drill targets that Sitka has outlined within the CCIC which all are connected by the road network on the project and occur in an area measuring five (5) km north-south and twelve (12) km east-west. Additional areas highlighted by strong gold in soil anomalies are being advanced to the drill ready stage with additional geological work in 2025.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6144/256905_3dc0f48084f9b993_009full.jpg

Quality Assurance/Quality Control

On receipt from the drill site, the HTW/NTW-sized drill core was systematically logged for geological attributes, photographed and sampled at Sitka's core logging facility. Sample lengths as small as 0.3 m were used to isolate features of interest, otherwise a default 2 m downhole sample length was used. Each sample is identified by a unique sample tag number which is placed in the bag containing the core to be assayed. Core was cut in half lengthwise along a predetermined line, with one-half (same half, consistently) collected for analysis and one-half stored as a record. Standard reference materials, blanks and duplicate samples were inserted by Sitka personnel at regular intervals into the sample stream. Bagged samples were placed in secure bins to ensure integrity during transport. They were delivered by Sitka personnel or a contract expeditor to ALS Laboratories' preparatory facility in Whitehorse, Yukon, with analyses completed in North Vancouver.

ALS is accredited to ISO 17025:2005 UKAS ref. 4028 for its laboratory analysis. Samples were crushed by ALS to over 70 per cent passing below two millimetres and split using a riffle splitter. One-thousand-gram splits were pulverized to over 85 per cent passing below 75 microns. Gold determinations are by fire assay with an inductively coupled plasma mass spectroscopy (ICP-AES) finish on 50 g subsamples of the prepared pulp (ALS code: Au-ICP-22). Any sample returning over 10 g/t gold was re-analyzed by fire assay with a gravimetric finish on a 50 g subsample (ALS code: Au-GRA21). In addition, a 51-element analysis was performed on a 0.5 g subsample of the prepared pulps by an aqua regia digestion followed by an inductively coupled plasma mass spectroscopy (ICP-MS) finish (ALS code: ME-MS41).

About the flagship RC Gold Project

Sitka's 100% owned RC Gold Project consists of a 431 square kilometre contiguous district-scale land package located in the heart of Yukon's Tombstone Gold Belt. The project is located approximately 100 kilometres east of Dawson City, which has a 5,000 foot paved runway, and is accessed via a secondary gravel road from the Klondike Highway which is usable year-round and is an approximate 2 hour drive from Dawson City. It is the largest consolidated land package strategically positioned mid-way between the Eagle Gold Mine and the past producing Brewery Creek Gold Mine.

The RC Gold Project now has pit-constrained mineral resources that are contained in two zones: the Blackjack and Eiger gold deposits with 1,291,000 ounces of gold in 39,962,000 tonnes grading 1.01 g/t gold in an indicated category and 1,044,000 ounces of gold in 34,603,000 tonnes grading 0.94 g/t in an inferred category at Blackjack and 440,000 ounces of gold in 27,362,000 tonnes grading 0.50 g/t gold in an inferred category at Eiger. These resource estimate numbers are supported by the recently updated technical report for RC Gold, prepared in accordance with NI 43-101 standards, entitled "Clear Creek Property, RC Gold Project NI 43-101 Technical Report Dawson Mining District, Yukon Territory", prepared by Ronald G. Simpson, P. Geo., of GeoSim Services Inc. with an effective date of January 21, 2025. This report is available on SEDAR+ (http://www.sedarplus.ca) and on the Company's website (www.sitkagoldcorp.com).

Both of these deposits begin at surface, are potentially open pit minable and amenable to heap leaching, with initial bottle roll tests indicating that the gold is not refractory and has high gold recoveries of up to 94% with minimal NaCN consumption (see News Release July 13, 2022).

As of the end of 2024, the Company has drilled 72 diamond drill holes into this system for a total of approximately 25,136 metres. Other targets drilled to date include the Saddle, Josephine, Rhosgobel and Pukelman zones. The resource expansion drilling in 2023 at Blackjack produced results of up to 219.0 metres of 1.34 g/t gold including 124.8 metres of 2.01 g/t gold and 55.0 metres of 3.11 g/t gold in drill hole DDRCCC-23-047 (see news release dated September 26, 2023) and in 2024 results of up to 678.1 metres of 1.04 g/t gold starting from surface in DDRCCC-24-068, including 409.5 metres of 1.36 g/t gold, 93.0 metres of 2.57 g/t gold and 5.5 metres of 17.59 g/t gold (see news release dated October 21, 2024). Results from DDRCCC-25-075, completed during winter drilling in 2025, produced the best high-grade intercepts drilled to date at Blackjack, returning 352.8 metres of 1.55 g/t gold including 108.9 metres of 3.27 g/t gold and 45.0 metres of 4.52 g/t gold (see news release dated April 22, 2025).

A planned 30,000 metre diamond drilling program for 2025 is currently underway at RC Gold.

RC Gold Deposit Model

Exploration on the Property has mainly focused on identifying an intrusion-related gold system ("IRGS"). The property is within the Tombstone Gold Belt which is the prominent host to IRGS deposits within the Tintina Gold Province in Yukon and Alaska. Notable deposits from the belt include: Fort Knox Mine in Alaska with current Proven and Probable Reserves of 230 million tonnes at 0.3 g/t Au (2.471 million ounces; Sims 2018)(1); Eagle Gold Mine with current Measured and Indicated Resources of 233 million tonnes at a grade of 0.57 g/t Au at the Eagle Main Zone (4.303 million ounces; Harvey et al, 2022)(2); the Brewery Creek deposit with current Indicated Mineral Resource of 22.2 million tonnes at a gold grade of 1.11 g/t (0.789 million ounces; Hulse et al. 2020)(3); the AurMac Project with an Inferred Mineral Resource of 347.49 million tonnes grading 0.63 gram per tonne gold (7.00 million ounces)(4) and the Valley Deposit, with a current Measured and Indicated Mineral Resource of 7.94 million oz gold at 1.21 g/t and an additional Inferred Mineral Resource of 0.89 million oz at 0.62 g/t gold(5), and the Raven deposit with an inferred mineral resource of 1.1 million oz (19.96 million tonnes at 1.67 g/t gold)(6).

(1) Sims J. Fort Knox Mine Fairbanks North Star Borough, Alaska, USA National Instrument 43-101 Technical Report. June 11, 2018. https://s2.q4cdn.com/496390694/files/doc_downloads...

(2) Harvey N., Gray P., Winterton J., Jutras M., Levy M.,Technical Report for the Eagle Gold Mine, Yukon Territory, Canada. Victoria Gold Corp. December 31, 2022. https://vgcx.com/site/assets/files/6534/vgcx_-_202...

(3) Hulse D, Emanuel C, Cook C. NI 43-101 Technical Report on Mineral Resources. Gustavson Associates. May 31, 2020. https://minedocs.com/22/Brewery-Creek-PEA-01182022...

(4) Thornton T., Jutras M., Malhotra D. Technical Report Aurmac Property Mayo Mining District, Yukon Territory, Canada. JDS Energy and Mining Inc. February 6, 2024. https://banyangold.com/site/assets/files/5251/bany...

(5)https://snowlinegold.com/2025/05/15/snowline-gold-...

(6) Jutras, M. 2022. Technical Report on the Raven Mineral Deposit, Mayo Mining District Yukon Territory, Canada, prepared for Victoria Gold Corp and filed on SEDAR (www.sedarplus.ca) with an effective date of September 15, 2022

The Company is also pleased to announce that it has completed the acquisition of the OGI Property, Yukon and the Burro Creek Property, Arizona pursuant to an option amending agreement with Fox Exploration Ltd. and Coelton Ventures Ltd., respectively. The Company now has a 100% interest in the OGI and Burro Creek properties subject to underlying royalties. For further information on the option amending agreements related to the Burro Creek Project and OGI Property, please refer to the Company's news release dated June 2, 2025.

Upcoming Events

Sitka Gold will be attending and/or presenting at the following events*:

- Take Stock - Calgary, AB : July 2 - 3, 2025

- Yukon Mining Alliance Property Tours - Dawson City, Yukon: July 11 - 14, 2025

- Precious Metals Summit, Beaver Creek, Colorado: September 9 - 12, 2025

- Yukon Geoscience Forum, Whitehorse, YT: November 16 - 19, 2025

- Swiss Mining Institute, Zürich, Switzerland: November 19 - 22, 2025

*All events are subject to change.

About Sitka Gold Corp.

Sitka Gold Corp. is a well-funded mineral exploration company headquartered in Canada. The Company is managed by a team of experienced industry professionals and is focused on exploring for economically viable mineral deposits with its primary emphasis on gold, silver and copper mineral properties of merit. Sitka is currently advancing its 100% owned, 431 square kilometre flagship RC Gold Project located within the Tombstone Gold Belt in the Yukon Territory. The Company is also advancing the Alpha Gold Project in Nevada and currently has drill permits for its Burro Creek Gold and Silver Project in Arizona and the Coppermine River Project in Nunavut, all of which are 100% owned by the Company.

*For more detailed information on the Company's properties please visit our website at www.sitkagoldcorp.com

The scientific and technical content of this news release has been reviewed and approved by Gilles Dessureau, P.Geo., V.P. Exploration of the Company, and a Qualified Person (QP) as defined by National Instrument 43-101.

ON BEHALF OF THE BOARD OF DIRECTORS OF

SITKA GOLD CORP.

"Donald Penner"

President and Director

For more information contact:

Donald Penner

President & Director

778-212-1950

[email protected]

or

Cor Coe

CEO & Director

604-817-4753

[email protected]

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary and Forward-Looking Statements

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". This information and these statements, referred to herein as "forward‐looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management's expectations and intentions and the Company's anticipated work programs.

These forward‐looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, market uncertainty and the results of the Company's anticipated work programs.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. We seek safe harbor.

Source