Chibougamau Copper-Gold Project, Canada

HIGHLIGHTS:

- Drilling at ‘Golden Eye' has returned shallow high-grade gold up to 9.1g/t Au in first assays with an intersection of:

- 3.3m @ 6.6g/t Au from just 131.7m including 2.3m @ 9.1g/t Au (LDR-25-05)

- Golden Eye was last drilled in the early 1990s when gold was less than US$350/oz. The entire drilling target sits outside the current resource

- Significant intersections from historic drilling 1 include:

- 5.9m @ 34.1g/t AuEq (32.2g/t Au, 1.2% Cu & 27.3g/t Ag) (RD-11)

- 4.5m @ 21.6g/t AuEq (14.9g/t Au, 4.7% Cu & 54g/t Ag) (RD-28)

- 8.4m @ 12.7g/t AuEq (11.0g/t Au, 1.3% Cu & 15.8g/t Ag) (RD-20)

- 7.5m @ 22.1g/t AuEq (16.0g/t Au & 4.7% Cu) (S1-87-1)

- 10.4m @ 12.2 g/t AuEq (7.3g/t Au, 3.5% Cu & 31.8g/t Ag) (S3-86-4)

- Subsequent holes drilled by Cygnus extended the known mineralisation down dip, where it remains open, with coarse visible gold* intersected in LDR-25-08 (awaiting assays - see photo below)

* Visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Visual estimates also potentially provide no information regarding impurities or deleterious physical properties relevant to valuations. The Company expects to receive the laboratory analytical results of the recent core sample (including LDR-25-08) between late April and early May.

- Gold was a significant part of the historic production within the Chibougamau District, with over 3.5Moz of gold produced alongside 945,000t of copper 3

- The recent drilling campaign at Golden Eye of six holes for 1,954m aimed to confirm historic drilling results and extend mineralisation at depth. Assay are pending for the remaining five holes

- The Company intends to utilise the recently compiled historic drill data totalling 77 holes for 21,371m to complete an initial Mineral Resource for Golden Eye

- Cygnus is continuing the process of digitising >100,000 documents including drill logs, some of which have not been looked at in over 30 years and never before in modern 3D software

- This highly cost-effective approach is assisting the team to conduct the first consolidated view of the geology and generate new drill targets as Cygnus looks to create shareholder value through resource growth, resource conversion and discovery with two rigs on site

| Cygnus Executive Chairman David Southam said : "Gold is a major part of the production history in the Chibougamau district. It is more than just a by-product, with production of 3.5Moz at an average grade of 2.1g/t Au. We already have 248,000oz of gold in Inferred Resources and 66,000oz in Measured and Indicated Resources, 2 and there is significant opportunity to add to these at Golden Eye with early high-grade results and visible gold down dip. "Golden Eye is fairly unique at Chibougamau in having a significantly higher proportion of gold than copper and was identified by the team early as an excellent gold-dominant drill target. We have a good head start by having the historic drill logs and will utilise this recently compiled data to assist in an initial Mineral Resource for Golden Eye''. |

Cygnus Metals Limited (ASX: CY5; TSXV: CYG; OTCQB: CYGGF) ("Cygnus" or the "Company") is pleased to announce high-grade gold assays and visible gold from its first drilling at the new target Golden Eye within the Chibougamau Copper-Gold Project in Quebec.

Assays of up to 9.1g/t Au alongside visible gold intersected down dip in recent drilling highlight the potential for additional resources and scope for further growth. Golden Eye was identified as a priority high-grade gold target which has not been drilled since the early 1990s when gold was less than US$350/oz. The entire target area sits outside of current resources with significant historic intersections of up to 5.9m @ 34.1g/t AuEq . 1

The identification of the Golden Eye target is a result of the ongoing compilation work which is helping to unlock this historic district as the Company continues to build upon the existing high-grade copper-gold resources with low-risk brownfield exploration. The Company currently has two rigs on site focussing on both resource growth and resource conversion drilling.

About Recent Drilling at Golden Eye

Golden Eye was identified as a priority drilling target at the Chibougamau Project with shallow high-grade gold mineralisation highlighted during the ongoing review of historic hardcopy drill logs, with the most recent drilling conducted in the early 1990s when gold price was less than US$350/oz. Historic drilling in the area returned some outstanding gold and copper grades 1 of:

- 5.9m @ 34.1g/t AuEq (32.2g/t Au, 1.2% Cu & 27.3g/t Ag) (RD-11);

- 4.5m @ 21.6g/t AuEq (14.9g/t Au, 4.7% Cu & 54g/t Ag) (RD-28);

- 8.4m @ 12.7g/t AuEq (11.0g/t Au, 1.3% Cu & 15.8g/t Ag) (RD-20);

- 7.5m @ 22.1g/t AuEq (16.0g/t Au & 4.7% Cu) (S1-87-1); and

- 10.4m @ 12.2 g/t AuEq (7.3g/t Au, 3.5% Cu & 31.8g/t Ag) (S3-86-4).

In 1992, a double access ramp was developed to access the mineralisation and to provide a better platform for drilling; however, low metal prices and a change of ownership shifted the focus to already established operating mines within the camp.

Cygnus recently completed a targeted 6-hole program for 1,954m, which aimed to confirm historic drilling results and extend mineralisation at depth. First assays from this drilling have confirmed the high-grade tenor of the shallow mineralisation with an intersection of:

- 3.3m @ 6.6g/t Au from 131.7m including 2.3m @ 9.1g/t Au (LDR-25-05)

Recent drilling has also extended mineralisation down dip to a depth of 400m below the surface, which remains open. Visual mineralisation intersected in drill hole LDR-25-08 highlighted coarse visible gold associated with chalcopyrite mineralisation over 0.9m from 463.8m downhole (refer Appendix B). Assays are pending for the five remaining holes of the program and are expected to be received in the current quarter. Once received, these results are expected to be incorporated into an updated geological model along with drilling completed by Doré Copper Mining Corp. in 2022/2023 which tested the conceptual structural model of the wider area.

The Chibougamau district has a strong history of gold production as well as copper, having produced 3.5Moz Au at an average grade of 2.1g/t Au. 3 Gold grades vary between different deposits although Golden Eye and Cedar Bay are the two areas with a significantly higher gold grade than other deposits within the camp.

Cygnus intends to utilise the recently completed drilling data (once all received) alongside the newly compiled historic drill data totalling 77 holes for 21,371m (both surface and underground drilling) to complete an initial Mineral Resource Estimate for the Golden Eye target. Golden Eye is an excellent example of the value generated through ongoing compilation work which is helping to unlock this historic district while the Company continues to build upon the existing high-grade copper-gold resources with low-risk brownfield exploration.

Ongoing Work

Cygnus is continuing to compile the data across the camp and deliver additional drill targets as the Company looks to execute its strategy of value creation through resource growth and conversion drilling. This low-cost, low-risk approach includes both surface and downhole electromagnetics ("EM") to generate brownfield targets around known high quality mineralisation.

Figure 1: Long Section of Golden Eye over 600m of strike with significant high grade gold up to 34.1gt AuEq over 5.9m. Mineralisation is still open at depth, with visible gold intersected in LDR-25-08. Refer to Appendix A of this release for newly released drill intercept and ASX releases dated 15 October 2024 and 25 March 2025 for previously announced drilling results.

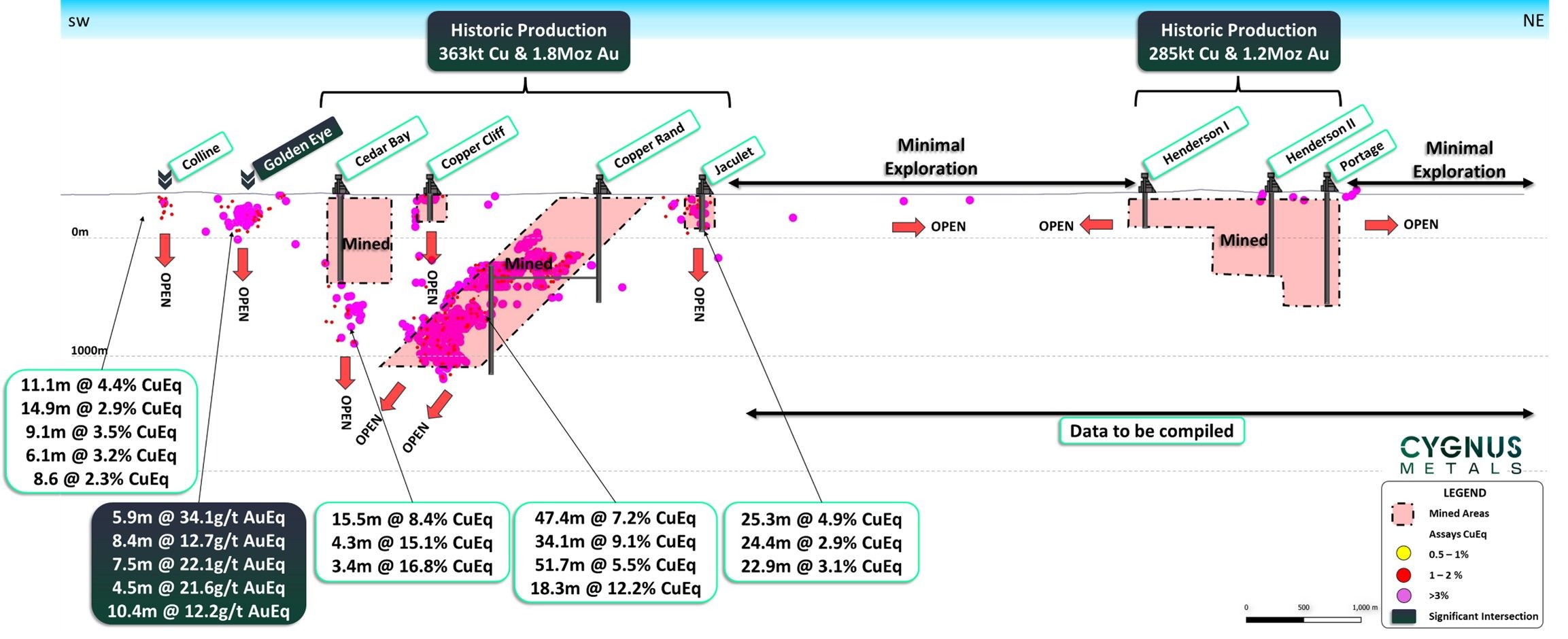

Figure 2: Long Section through the Chibougamau North Camp illustrating Golden Eye with standout intersections of up to 5.9m @ 34.1g/t AuEq. Refer to ASX releases dated 15 October 2024 and 25 March 2025 for previously announced drilling results.

This announcement has been authorised for release by the Board of Directors of Cygnus.

| David Southam Executive Chair T: +61 8 6118 1627 E: [email protected] | Ernest Mast President & Managing Director T: +1 647 921 0501 E: [email protected] | Media: Paul Armstrong Read Corporate T: +61 8 9388 1474 |

About Cygnus Metals

Cygnus Metals Limited (ASX: CY5, TSXV: CYG, OTCQB: CYGGF) is a diversified critical minerals exploration and development company with projects in Quebec, Canada and Western Australia. The Company is dedicated to advancing its Chibougamau Copper-Gold Project in Quebec with an aggressive exploration program to drive resource growth and develop a hub-and-spoke operation model with its centralised processing facility. In addition, Cygnus has quality lithium assets with significant exploration upside in the world-class James Bay district in Quebec, and REE and base metal projects in Western Australia. The Cygnus team has a proven track record of turning exploration success into production enterprises and creating shareholder value.

Cautionary Note – Visual Estimates

In relation to the disclosure of visible mineralisation, the Company cautions that visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analysis. Laboratory assay results are required to determine the widths and grade of the visible mineralisation reported in preliminary geological logging. The Company will update the market when laboratory analytical results become available. The reported intersections are down hole lengths and are not necessarily true width. Descriptions of the mineral amounts seen and logged in the core are qualitative only. Quantitative assays will be completed by Bureau Veritas, with the results for those intersections discussed in this release expected between late April and early May.

Forward Looking Statements

This release may contain certain forward-looking statements and projections regarding estimates, resources and reserves; planned production and operating costs profiles; planned capital requirements; and planned strategies and corporate objectives. Such forward looking statements/projections are estimates for discussion purposes only and should not be relied upon. They are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors, many of which are beyond Cygnus' control. Cygnus makes no representations and provides no warranties concerning the accuracy of the projections and disclaims any obligation to update or revise any forward-looking statements/projections based on new information, future events or otherwise except to the extent required by applicable laws. While the information contained in this release has been prepared in good faith, neither Cygnus or any of its directors, officers, agents, employees or advisors give any representation or warranty, express or implied, as to the fairness, accuracy, completeness or correctness of the information, opinions and conclusions contained in this release. Accordingly, to the maximum extent permitted by law, none of Cygnus, its directors, employees or agents, advisers, nor any other person accepts any liability whether direct or indirect, express or limited, contractual, tortuous, statutory or otherwise, in respect of the accuracy or completeness of the information or for any of the opinions contained in this release or for any errors, omissions or misstatements or for any loss, howsoever arising, from the use of this release.

End Notes

- Refer to Cygnus' ASX announcements dated 15 October 2024 and 25 March 2025.

- The Mineral Resource estimate at the Chibougamau Project is a foreign estimate prepared in accordance with CIM Standards. A competent person has not done sufficient work to classify the foreign estimate as a mineral resource in accordance with the JORC Code, and it is uncertain whether further evaluation and exploration will result in an estimate reportable under the JORC Code. Refer to Appendix C for a breakdown of the Mineral Resource Estimate.

- Historic production statistics for the Chibougamau area are recorded in Leclerc. F, Harris. L. B, Bedard. J. H, Van Breeman. O and Goulet. N. 2012, Structural and Stratigraphic Controls on Magmatic, Volcanogenic, and Shear Zone-Hosted Mineralization in the Chapais-Chibougamau Mining Camp, Northeastern Abitibi, Canada. Society of Economic Geologists, Inc. Economic Geology, v. 107, pp. 963–989.

Qualified Persons and Compliance Statements

The scientific and technical information in this announcement has been reviewed and approved by Mr Louis Beaupre, the Quebec Exploration Manager of Cygnus, a "qualified person" as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects. The Exploration Results disclosed in this announcement are also based on and fairly represent information and supporting documentation compiled by Mr Beaupre. Mr Beaupre holds options in Cygnus. Mr Beaupre is a member of the Ordre des ingenieurs du Quebec (P. Eng.), a Registered Overseas Professional Organisation as defined in the ASX Listing Rules, and has sufficient experience which is relevant to the style of mineralisation and type of deposits under consideration and to the activity which has been undertaken to qualify as a Competent Person as defined in the 2012 Edition of the "Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves". Mr Beaupre consents to the inclusion in this release of the matters based on the information in the form and context in which they appear.

The Company first announced the foreign estimate of mineralisation for the Chibougamau Project on 15 October 2024. The Company confirms that the supporting information included in the original announcement continues to apply and has not materially changed, notwithstanding the clarification announcement released by Cygnus on 28 January 2025 ("Clarification"). Cygnus confirms that (notwithstanding the Clarification) it is not aware of any new information or data that materially affects the information included in the original announcement and that all material assumptions and technical parameters underpinning the estimates in the original announcement continue to apply and have not materially changed. Cygnus confirms that it is not in possession of any new information or data that materially impacts on the reliability of the estimates or Cygnus' ability to verify the foreign estimates as mineral resources in accordance with the JORC Code. The Company confirms that the form and context in which the Competent Persons' findings are presented have not been materially modified from the original market announcement.

The information in this announcement that relates to previously reported Exploration Results at the Company's projects has been previously released by Cygnus in ASX Announcements as noted in the text and End Notes. Cygnus is not aware of any new information or data that materially affects the information in these announcements. The Company confirms that the form and context in which the Competent Persons' findings are presented have not been materially modified from the original market announcements.

Individual grades for the metals included in the metal equivalents calculation for the foreign estimate are in Appendix C of this release. Metal equivalents for the foreign estimate of mineralisation have been calculated at a copper price of US$8,750/t, gold price of US$2,350/oz, with copper equivalents calculated based on the formula CuEq (%) = Cu(%) + (Au (g/t) x 0.77258). Individual grades for the metals included in the metal equivalents calculation for the exploration results are in Appendix A of this release. Metal equivalents for exploration results have been calculated at a copper price of US$8,750/t, gold price of US$2,350/oz and silver price of US$25/oz. Copper equivalents are calculated based on the formula CuEq(%) = Cu(%) + (Au(g/t) x 0.77258)+(Ag(g/t) x 0.00822). Gold equivalents are calculated based on the formula AuEq(g/t) = Au(g/t) +(Cu(%) x 1.29436)+(Ag(g/t) x 0.01064). Metallurgical recovery factors have been applied to the metal equivalents calculations, with copper metallurgical recovery assumed at 95% and precious metal (gold and silver) metallurgical recovery assumed at 85% based upon historical production at the Chibougamau Processing Facility, and the metallurgical results contained in Cygnus' announcement dated 28 January 2025. It is the Company's view that all elements in the metal equivalents calculations in respect of the foreign estimate and exploration results have a reasonable potential to be recovered and sold.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

APPENDIX A – Significant Intersections from Recent Drilling at Golden Eye

Coordinates given in UTM NAD83 (Zone 18). Intercept lengths may not add up due to rounding to the appropriate reporting precision. Significant intersections reported above 2g/t AuEq over widths of greater than 1m. True width estimated to be 80% of downhole thickness.

| Hole ID | X | Y | Z | Azi | Dip | Depth (m) | From (m) | To (m) | Interval (m) | Au (g/t) | Cu (%) | AuEq (g/t) |

| LDR-25-05 | 549448 | 5525296 | 375 | 227 | -45 | 214.2 | 131.7 | 135.0 | 3.3 | 6.6 | 0.0 | 6.6 |

| Including | 131.7 | 134 | 2.3 | 9.1 | 0.0 | 9.1 | ||||||

| LDR-25-06 | 549560 | 5525483 | 375 | 215 | -51 | 474.0 | Pending Assays | |||||

| LDR-25-07 | 549453 | 5525313 | 375 | 215 | -55 | 261.0 | ||||||

| LDR-25-08 | 549524 | 5525441 | 375 | 246 | -57 | 516.0 | ||||||

| LDR-25-09 | 549445 | 5525319 | 375 | 238 | -54 | 252.0 | ||||||

| LDR-25-10 | 549489 | 5525229 | 375 | 220 | -60 | 237.0 | ||||||

APPENDIX B - Summary Logging Details for Mineralised Intersections Observed in LDR-25-08

| Hole ID | From | To | Interval | Mineral 1 | % | Mineral 2 | % | Mineral 3 | % | Visible Gold | Total Sulphide (%) | |

| LDR-25-08 | 89.0 | 90.0 | 1.0 | Pyrite | 2.0 | - | 2.0 | |||||

| LDR-25-08 | 166.4 | 211.1 | 44.7 | Pyrite | 0.5 | - | 0.5 | |||||

| LDR-25-08 | 211.1 | 216.0 | 4.9 | Pyrite | 0.1 | - | 0.1 | |||||

| LDR-25-08 | 216.0 | 216.6 | 0.6 | Pyrite | 1.0 | - | 1.0 | |||||

| LDR-25-08 | 216.6 | 354.8 | 138.2 | Pyrite | 0.1 | - | 0.1 | |||||

| LDR-25-08 | 360.4 | 361.3 | 0.9 | Chalcopyrite | 0.5 | Pyrite | 1.0 | - | 1.5 | |||

| LDR-25-08 | 363.9 | 392.1 | 28.2 | Chalcopyrite | 0.3 | Pyrite | 0.5 | - | 0.8 | |||

| LDR-25-08 | 392.1 | 397.3 | 5.3 | Pyrite | 0.3 | - | 0.3 | |||||

| LDR-25-08 | 397.3 | 405.6 | 8.3 | Chalcopyrite | 0.1 | - | 0.1 | |||||

| LDR-25-08 | 405.6 | 406.1 | 0.5 | Chalcopyrite | 0.3 | Pyrite | 30.0 | - | 30.3 | |||

| LDR-25-08 | 406.1 | 407.9 | 1.8 | Chalcopyrite | 0.5 | Pyrite | 1.5 | - | 2.0 | |||

| LDR-25-08 | 407.9 | 408.3 | 0.4 | Pyrite | 7.0 | Chalcopyrite | 0.1 | - | 7.1 | |||

| LDR-25-08 | 408.3 | 409.0 | 0.7 | Pyrite | 0.1 | - | 0.1 | |||||

| LDR-25-08 | 409.0 | 409.4 | 0.4 | Pyrite | 25.0 | Chalcopyrite | 25.0 | - | 50.0 | |||

| LDR-25-08 | 409.4 | 411.7 | 2.3 | Chalcopyrite | 3.0 | Pyrite | 7.0 | - | 10.0 | |||

| LDR-25-08 | 411.7 | 411.9 | 0.2 | Sphalerite | 2.0 | Chalcopyrite | 0.5 | Pyrite | 15.0 | - | 17.5 | |

| LDR-25-08 | 411.9 | 415.1 | 3.2 | Chalcopyrite | 1.0 | Pyrite | 3.0 | - | 4.0 | |||

| LDR-25-08 | 415.1 | 420.8 | 5.8 | Chalcopyrite | 0.3 | Pyrite | 1.0 | - | 1.3 | |||

| LDR-25-08 | 420.8 | 423.3 | 2.4 | Chalcopyrite | 1.5 | Pyrite | 2.5 | - | 4.0 | |||

| LDR-25-08 | 423.3 | 428.3 | 5.1 | Chalcopyrite | 0.1 | Pyrite | 0.1 | - | 0.2 | |||

| LDR-25-08 | 428.3 | 455.0 | 26.7 | Pyrite | 0.5 | - | 0.5 | |||||

| LDR-25-08 | 457.6 | 458.1 | 0.4 | Sphalerite | 0.1 | Chalcopyrite | 1.0 | Pyrite | 0.5 | - | 1.6 | |

| LDR-25-08 | 461.2 | 461.8 | 0.6 | Chalcopyrite | 2.0 | - | 2.0 | |||||

| LDR-25-08 | 463.8 | 464.6 | 0.9 | Chalcopyrite | 5.0 | Pyrite | 2.0 | 0.1 | % | 7.1 | ||

| LDR-25-08 | 464.6 | 478.6 | 14.0 | Chalcopyrite | 1.0 | Pyrite | 0.5 | - | 1.5 | |||

| LDR-25-08 | 478.6 | 479.7 | 1.1 | Chalcopyrite | 3.0 | Pyrite | 8.0 | - | 11.0 | |||

| LDR-25-08 | 480.6 | 516.0 | 35.4 | Chalcopyrite | 0.2 | Pyrite | 0.1 | - | 0.3 | |||

APPENDIX C – Chibougamau Copper-Gold Project – Foreign Mineral Resource Estimate Disclosures as at 30 March 2022

| Deposit | Category | Tonnes (k) | Cu Grade (%) | Au Grade (g/t) | Cu Metal (kt) | Au Metal (koz) | CuEq Grade (%) |

| Corner Bay (2022) | Indicated | 2,700 | 2.7 | 0.3 | 71 | 22 | 2.9 |

| Inferred | 5,900 | 3.4 | 0.3 | 201 | 51 | 3.6 | |

| Devlin (2022) | Measured | 120 | 2.7 | 0.3 | 3 | 1 | 2.9 |

| Indicated | 660 | 2.1 | 0.2 | 14 | 4 | 2.3 | |

| Measured & Indicated | 780 | 2.2 | 0.2 | 17 | 5 | 2.4 | |

| Inferred | 480 | 1.8 | 0.2 | 9 | 3 | 2.0 | |

| Joe Mann (2022) | Inferred | 610 | 0.2 | 6.8 | 1 | 133 | 5.5 |

| Cedar Bay (2018) | Indicated | 130 | 1.6 | 9.4 | 2 | 39 | 8.9 |

| Inferred | 230 | 2.1 | 8.3 | 5 | 61 | 8.5 | |

| Total | Measured & Indicated | 3,600 | 2.5 | 0.6 | 90 | 66 | 3.0 |

| Inferred | 7,200 | 3.0 | 1.1 | 216 | 248 | 3.8 |

APPENDIX D – 2012 JORC Table 1

Section 1 Sampling Techniques and Data

| Criteria | JORC Code explanation | Commentary |

| Sampling techniques | Nature and quality of sampling (eg cut channels, random chips, or specific specialised industry standard measurement tools appropriate to the minerals under investigation, such as down hole gamma sondes, or handheld XRF instruments, etc). These examples should not be taken as limiting the broad meaning of sampling. |

|

| Include reference to measures taken to ensure sample representivity and the appropriate calibration of any measurement tools or systems used. |

| |

| Aspects of the determination of mineralisation that are Material to the Public Report. In cases where ‘industry standard' work has been done this would be relatively simple (eg ‘reverse circulation drilling was used to obtain 1 m samples from which 3 kg was pulverised to produce a 30 g charge for fire assay'). In other cases more explanation may be required, such as where there is coarse gold that has inherent sampling problems. Unusual commodities or mineralisation types (eg submarine nodules) may warrant disclosure of detailed information. |

| |

| Drilling techniques | Drill type (eg core, reverse circulation, open-hole hammer, rotary air blast, auger, Bangka, sonic, etc) and details (eg core diameter, triple or standard tube, depth of diamond tails, face-sampling bit or other type, whether core is oriented and if so, by what method, etc). |

|

| Drill sample recovery | Method of recording and assessing core and chip sample recoveries and results assessed. Measures taken to maximise sample recovery and ensure representative nature of the samples. Whether a relationship exists between sample recovery and grade and whether sample bias may have occurred due to preferential loss/gain of fine/coarse material. |

|

| Logging | Whether core and chip samples have been geologically and geotechnically logged to a level of detail to support appropriate Mineral Resource estimation, mining studies and metallurgical studies. |

|

| Whether logging is qualitative or quantitative in nature. Core (or costean, channel, etc) photography. |

| |

| The total length and percentage of the relevant intersections logged. |

| |

| Sub-sampling techniques and sample preparation | If core, whether cut or sawn and whether quarter, half or all core taken. If non-core, whether riffled, tube sampled, rotary split, etc and whether sampled wet or dry. For all sample types, the nature, quality and appropriateness of the sample preparation technique. Quality control procedures adopted for all sub-sampling stages to maximise representivity of samples. Measures taken to ensure that the sampling is representative of the in-situ material collected, including for instance results for field duplicate/second-half sampling. Whether sample sizes are appropriate to the grain size of the material being sampled. |

|

| Quality of assay data and laboratory tests | The nature, quality and appropriateness of the assaying and laboratory procedures used and whether the technique is considered partial or total. |

|

| For geophysical tools, spectrometers, handheld XRF instruments, etc, the parameters used in determining the analysis including instrument make and model, reading times, calibrations factors applied and their derivation, etc. |

| |

| Nature of quality control procedures adopted (eg standards, blanks, duplicates, external laboratory checks) and whether acceptable levels of accuracy (i.e. lack of bias) and precision have been established. |

| |

| Verification of sampling and assaying | The verification of significant intersections by either independent or alternative company personnel. |

|

| The use of twinned holes. |

| |

| Documentation of primary data, data entry procedures, data verification, data storage (physical and electronic) protocols. |

| |

| Discuss any adjustment to assay data. |

| |

| Location of data points | Accuracy and quality of surveys used to locate drill holes (collar and down-hole surveys), trenches, mine workings and other locations used in Mineral Resource estimation. |

|

| Specification of the grid system used. |

| |

| Quality and adequacy of topographic control. |

| |

| Data spacing and distribution | Data spacing for reporting of Exploration Results. |

|

| Whether the data spacing and distribution is sufficient to establish the degree of geological and grade continuity appropriate for the Mineral Resource and Ore Reserve estimation procedure(s) and classifications applied. |

| |

| Whether sample compositing has been applied. |

| |

| Orientation of data in relation to geological structure | Whether the orientation of sampling achieves unbiased sampling of possible structures and the extent to which this is known, considering the deposit type. |

|

| If the relationship between the drilling orientation and the orientation of key mineralised structures is considered to have introduced a sampling bias, this should be assessed and reported if material. |

| |

| Sample security | The measures taken to ensure sample security. |

|

| Audits or reviews | The results of any audits or reviews of sampling techniques and data. |

|

Section 2 Reporting of Exploration Results

(Criteria listed in the preceding section also apply to this section.)

| Criteria | JORC Code Explanation | Commentary |

| Mineral tenement and land tenure status | Type, reference name/number, location and ownership including agreements or material issues with third parties such as joint ventures, partnerships, overriding royalties, native title interests, historical sites, wilderness or national park and environmental settings. |

|

| The security of the tenure held at the time of reporting along with any known impediments to obtaining a licence to operate in the area. |

| |

| Exploration done by other parties | Acknowledgment and appraisal of exploration by other parties. |

|

| Geology | Deposit type, geological setting and style of mineralisation. |

|

| Drill hole Information | A summary of all information material to the understanding of the exploration results including a tabulation of the following information for all Material drill holes:

|

|

| Data aggregation methods | In reporting Exploration Results, weighting averaging techniques, maximum and/or minimum grade truncations (eg cutting of high grades) and cut-off grades are usually Material and should be stated. |

|

| Where aggregate intercepts incorporate short lengths of high-grade results and longer lengths of low-grade results, the procedure used for such aggregation should be stated and some typical examples of such aggregations should be shown in detail. |

| |

| The assumptions used for any reporting of metal equivalent values should be clearly stated. |

| |

| Relationship between mineralisation widths and intercept lengths | These relationships are particularly important in the reporting of Exploration Results. If the geometry of the mineralisation with respect to the drill hole angle is known, its nature should be reported. If it is not known and only the down hole lengths are reported, there should be a clear statement to this effect (eg ‘down hole length, true width not known'). |

|

| Diagrams | Appropriate maps and sections (with scales) and tabulations of intercepts should be included for any significant discovery being reported. These should include,but not be limited to a plan view of drill hole collar locations and appropriate sectional views. |

|

| Balanced reporting | Where comprehensive reporting of all Exploration Results is not practicable, representative reporting of both low and high grades and/or widths should be practiced to avoid misleading reporting of Exploration Results. |

|

| Other substantive exploration data | Other exploration data, if meaningful and material, should be reported including (but not limited to): geological observations; geophysical survey results; geochemical survey results; bulk samples – size and method of treatment; metallurgical test results; bulk density, groundwater, geotechnical and rock characteristics; potential deleterious or contaminating substances. |

|

| Further work | The nature and scale of planned further work (eg tests for lateral extensions or depth extensions or large-scale step-out drilling). Diagrams clearly highlighting the areas of possible extensions, including the main geological interpretations and future drilling areas, provided this information is not commercially sensitive. |

|

Figure 3: Plan view of recent drilling relative to historic drilling and the 1992 ramp access

Photos accompanying this announcement are available at:

Figure 1: Drill core from CB-25-118 with 4.4% CuEq over 9.1m from 545m, including a high grade interval of 7.6% CuEq over 3.4m. Showing style and high-grade tenor of mineralisation at Corner Bay.

Figure 1: Drill core from CB-25-118 with 4.4% CuEq over 9.1m from 545m, including a high grade interval of 7.6% CuEq over 3.4m. Showing style and high-grade tenor of mineralisation at Corner Bay.